Cracking The Code On Los Angeles County Property Tax: A Comprehensive Guide

So, you've landed here because you're probably wondering about Los Angeles County property tax and how it works. Whether you're a homeowner, an aspiring buyer, or just someone trying to understand the ins and outs of property taxes, you're in the right place. Property taxes can feel like a maze, but don't worry—we've got your back. Let's break it down together and make sense of it all.

Now, I know what you're thinking: "Why do I even need to care about Los Angeles County property tax?" Well, my friend, property taxes are more than just numbers on a bill. They're the backbone of local government funding, and understanding them can save you a ton of cash in the long run. Trust me, no one likes surprises when it comes to money, especially when it's tied to your biggest investment—your home.

And guess what? We're not just throwing random facts at you. This guide is packed with practical tips, insider info, and real-world examples to help you navigate the world of Los Angeles County property tax like a pro. So grab a cup of coffee, get comfy, and let's dive in!

Table of Contents:

- What is Property Tax?

- How is Property Tax Calculated?

- Los Angeles County Property Tax Rate

- The Property Tax Assessment Process

- Common Property Tax Exemptions

- Paying Your Property Tax

- Avoiding Property Tax Penalties

- The Property Tax Appeals Process

- Property Tax Trends in Los Angeles County

- Tips for Saving on Property Tax

What is Property Tax?

Alright, let's start with the basics. Property tax, in simple terms, is a tax levied on real estate based on its assessed value. It's like a fee you pay to the government for the privilege of owning property. In Los Angeles County, property tax is a major source of revenue that funds essential services like schools, law enforcement, fire departments, and public infrastructure.

But here's the thing: property tax isn't a one-size-fits-all deal. The amount you pay depends on various factors, including the location, size, and type of your property. And let's not forget about those special assessments that can pop up unexpectedly. We'll get into all that later, but for now, just remember that property tax is a crucial part of homeownership.

Why Does Property Tax Matter?

Property tax matters because it directly impacts your finances. Think about it: if you're not careful, those taxes can add up quickly and eat into your budget. Plus, if you fail to pay them on time, you could face penalties, liens, or even lose your property. Yikes, right? That's why it's so important to understand how property tax works and stay on top of it.

How is Property Tax Calculated?

Let's talk numbers. The way property tax is calculated in Los Angeles County is pretty straightforward, but there are a few key steps involved. First, the county assessor determines the assessed value of your property. This is typically based on the property's market value at the time of purchase, plus any annual increases allowed by Proposition 13.

Once the assessed value is established, it's multiplied by the tax rate, which is usually around 1% in Los Angeles County. But hold up—there's more. In addition to the base tax rate, you might also have to pay special assessments or fees for things like water districts, school bonds, or community facilities. These extras can vary depending on where your property is located.

Breaking It Down

Here's a quick breakdown of how property tax is calculated:

- Assessed Value × Tax Rate = Base Tax

- Base Tax + Special Assessments = Total Property Tax

For example, if your property has an assessed value of $500,000 and the tax rate is 1%, your base tax would be $5,000. Add any special assessments, say $500, and your total property tax would be $5,500. Easy peasy, right?

Los Angeles County Property Tax Rate

Now, let's zoom in on the property tax rate in Los Angeles County. As of 2023, the base tax rate is capped at 1% thanks to Proposition 13, a state law that limits property tax increases. However, as I mentioned earlier, you might also have to pay additional assessments, which can push your effective tax rate higher.

According to data from the Los Angeles County Assessor's Office, the average effective property tax rate in the county is around 1.25%. But keep in mind, this can vary depending on your specific location and the types of assessments that apply to your property. Some areas might have higher rates due to special districts or bond measures.

Understanding Proposition 13

Proposition 13, passed in 1978, was a game-changer for property owners in California. It capped property tax rates at 1% of assessed value and limited annual increases to no more than 2%. This means that even if your property's market value skyrockets, your taxes won't increase dramatically unless you make major improvements or sell the property.

The Property Tax Assessment Process

So, how does the property tax assessment process work in Los Angeles County? Every year, the county assessor reviews your property to determine its assessed value. This is usually based on the property's market value at the time of purchase, plus any annual increases allowed by Proposition 13.

But what happens if you make improvements to your property, like adding a pool or remodeling your kitchen? Well, those changes can trigger a reassessment, which might increase your assessed value—and therefore your property tax bill. That's why it's important to keep track of any major renovations or additions you make to your home.

What Triggers a Reassessment?

Here are some common triggers for a property tax reassessment:

- Purchase of the property

- Major renovations or additions

- Change in ownership

- Damage or destruction of the property

If you're concerned about a reassessment, don't hesitate to reach out to the county assessor's office for clarification. They're there to help, and it's always better to be informed.

Common Property Tax Exemptions

Good news: there are ways to reduce your Los Angeles County property tax bill. The state of California offers several exemptions and deductions that can help lower your tax burden. Some of the most common ones include:

- Homeowners' Exemption: If you use your property as your primary residence, you might qualify for a $7,000 reduction in assessed value.

- Senior Citizen Exemption: Homeowners aged 55 or older may be eligible for a property tax deferral program.

- Disability Exemption: Disabled homeowners can apply for a reduction in property taxes.

- Green Building Incentives: If you install energy-efficient features, you might qualify for a tax break.

Be sure to check with the county assessor's office to see if you qualify for any of these exemptions. It could save you a ton of money!

How to Apply for Exemptions

Applying for property tax exemptions is usually a straightforward process. You'll need to fill out an application form and provide supporting documentation, such as proof of age, disability, or energy-efficient upgrades. The county assessor's office will review your application and let you know if you qualify.

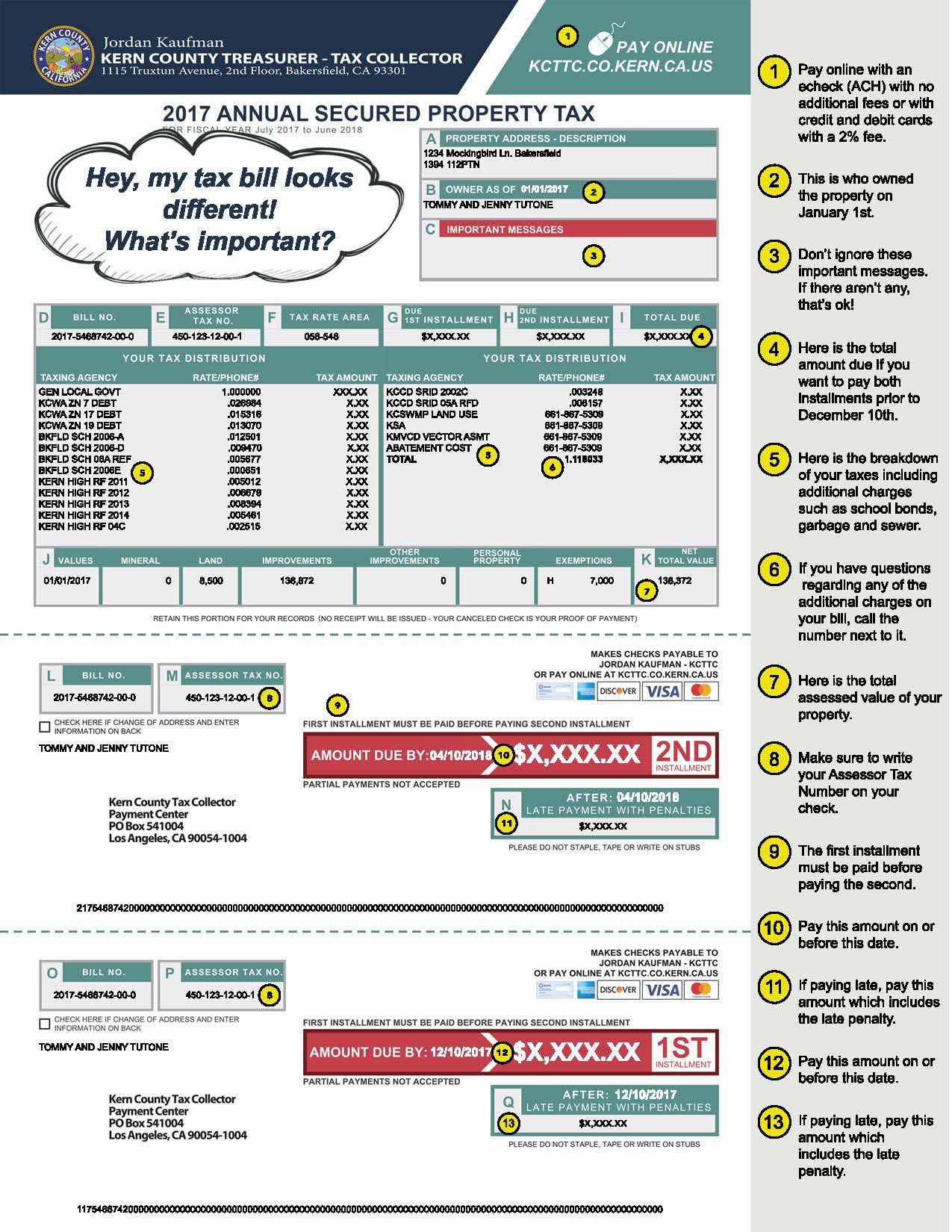

Paying Your Property Tax

Alright, let's talk about the nitty-gritty: paying your property tax. In Los Angeles County, property taxes are typically due in two installments: the first by December 10 and the second by April 10. If you miss either deadline, you'll face late fees and penalties, so it's crucial to pay on time.

Fortunately, paying property taxes has never been easier. You can pay online through the county treasurer's website, by mail, or even in person at designated payment centers. Some homeowners also choose to escrow their property taxes through their mortgage lender, which means the lender pays the taxes on their behalf.

What Happens If You Don't Pay?

Failure to pay your property taxes can have serious consequences. If you miss the deadlines, you'll incur late fees and interest charges. If the debt remains unpaid for a long period, the county could place a tax lien on your property or even initiate foreclosure proceedings. Trust me, you don't want to go down that road.

Avoiding Property Tax Penalties

Now that we've covered the risks of not paying your property taxes, let's talk about how to avoid penalties altogether. The simplest way is to pay on time, obviously. But if you're struggling to make the payment, there are options available to help you out.

For example, Los Angeles County offers a payment plan program that allows homeowners to pay their taxes in installments. There's also assistance available for low-income seniors, disabled individuals, and other vulnerable groups. Don't be afraid to reach out for help if you need it.

Setting Up Payment Reminders

One of the easiest ways to avoid late payments is to set up reminders. You can sign up for email or text notifications through the county treasurer's website, or even mark the due dates on your calendar. A little organization can go a long way in keeping your finances in check.

The Property Tax Appeals Process

If you believe your property tax assessment is unfair or inaccurate, you have the right to appeal. The property tax appeals process in Los Angeles County involves filing a formal complaint with the county assessor's office. You'll need to provide evidence to support your claim, such as recent sales data or an appraisal report.

Once your appeal is submitted, the assessor's office will review it and either grant or deny your request. If you're not satisfied with the outcome, you can take your case to the Los Angeles County Assessment Appeals Board for further review.

How to File an Appeal

Filing a property tax appeal is a relatively simple process. Here's what you need to do:

- Complete the appeal application form

- Gather supporting documentation

- Submit your appeal by the deadline

- Attend any required hearings or meetings

Remember, the more evidence you can provide, the stronger your case will be. So don't skimp on the details!

Property Tax Trends in Los Angeles County

Let's talk about the bigger picture: property tax trends in Los Angeles County. Over the past few years, we've seen significant changes in the real estate market, which have had a direct impact on property taxes. Rising home prices, for instance, have led to higher assessed values and, consequently, higher tax bills for many homeowners.

At the same time, the state has introduced new laws and initiatives aimed at addressing these challenges. For example, Proposition 19, passed in 2020, allows homeowners over 55 to transfer their tax base when moving to a new home. This has been a game-changer for many seniors looking to downsize or relocate.

What's on the Horizon?

Looking ahead, there are a few key trends to watch out for. As the housing market continues to evolve, we may see further adjustments to property tax laws and regulations. Additionally, the push for more energy-efficient homes could lead to more tax incentives for green building projects.

Tips for Saving on Property Tax

Finally, let's wrap things up with some practical tips for saving on property tax in Los Angeles County. Here are a few strategies to consider:

- Review your assessment annually to ensure accuracy

- Apply for available exemptions and deductions

- Explore payment plan

Los Angeles County Property Tax Website

Los Angeles County Property Tax Website

la county tax collector mailing address Vinita Witt