Dave Ramsey Retirement Investing Calculator: Your Ultimate Guide To Secure Tomorrow

Imagine this: you're sitting at your favorite coffee shop, sipping on a latte, and wondering how much money you'll need to retire comfortably. Well, my friend, Dave Ramsey has got your back with his retirement investing calculator. It's like having a financial genie in your pocket! But hold up—before you dive in, let's break down why this tool is so important and how it can change your financial future.

Retirement might feel like a distant dream, but the truth is, the earlier you start planning, the better off you'll be. Dave Ramsey's retirement investing calculator isn't just another online tool; it's a game-changer for anyone serious about securing their golden years. Whether you're in your 20s or nearing your 50s, this calculator can help you figure out exactly how much you need to save and invest to live the life you want when you retire.

Now, I know what you're thinking: "Is this really necessary?" or "Can't I just wing it?" Let me tell you, winging it when it comes to retirement is like trying to fly a plane without a pilot—you're bound to crash. The good news? With Dave Ramsey's calculator, you'll have all the tools you need to create a solid financial plan. So, let's dive into the details and make sure you're set up for success!

Why You Need the Dave Ramsey Retirement Investing Calculator

Let's be real for a second—retirement planning can feel overwhelming. There are so many numbers to crunch, goals to set, and investments to consider. That's where the Dave Ramsey retirement investing calculator comes in. It simplifies the process and gives you a clear path forward. Here's why you need it:

- Personalized Results: The calculator takes into account your current financial situation, income, expenses, and savings goals to give you a tailored plan.

- Goal-Oriented: Whether you're aiming to retire early or just want to ensure a comfortable lifestyle, the calculator helps you set and achieve your financial goals.

- Easy to Use: No fancy math or complicated spreadsheets required. Just input your info, and the calculator does the rest.

Think of it like a personal financial coach that's available 24/7. It's not just about crunching numbers—it's about giving you peace of mind knowing that you're on track for the future you deserve.

How the Calculator Works

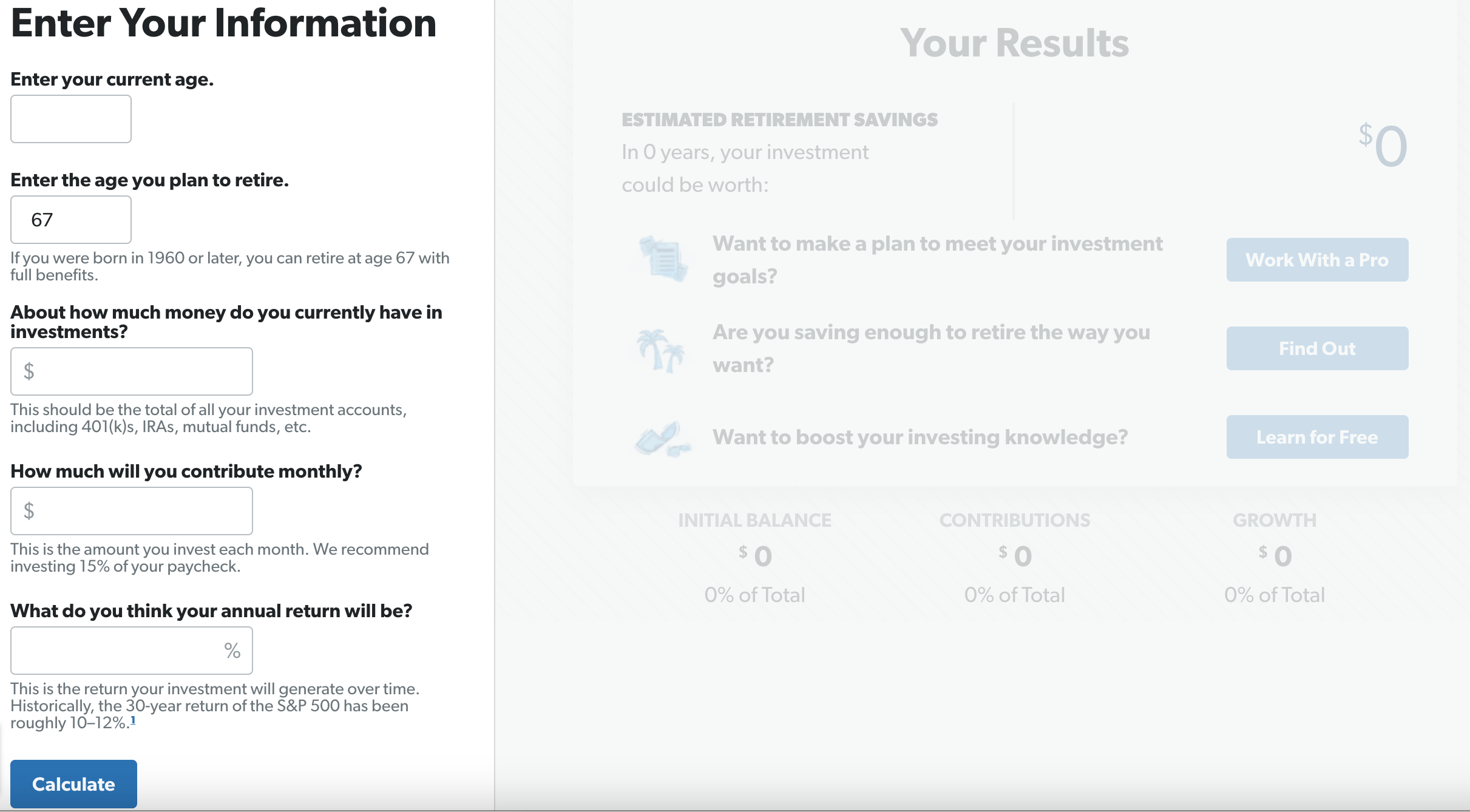

Alright, so you're sold on the idea, but how does it actually work? The Dave Ramsey retirement investing calculator is designed to be user-friendly and straightforward. Here's a step-by-step breakdown:

Step 1: Enter Your Information – You'll need to input some basic details like your age, current savings, expected retirement age, and annual contributions. Don't worry; the calculator will guide you through each field.

Step 2: Set Your Goals – Decide how much money you want to have in retirement and what kind of lifestyle you envision. The calculator will help you determine if your goals are realistic and adjust them if needed.

Step 3: Review Your Results – Once you've entered all the necessary info, the calculator will generate a detailed report showing you exactly how much you need to save each month to reach your goals.

It's like having a crystal ball for your financial future. You'll see exactly where you stand and what steps you need to take to get where you want to be.

Key Features of the Calculator

What makes the Dave Ramsey retirement investing calculator stand out from the rest? Here are some of its key features:

- Comprehensive Planning: It covers everything from Social Security estimates to inflation rates, giving you a complete picture of your retirement needs.

- Flexible Scenarios: You can run different scenarios to see how changes in contributions or retirement age affect your overall plan.

- Investment Guidance: The calculator also provides recommendations on where to invest your money based on your risk tolerance and time horizon.

These features make it an invaluable tool for anyone serious about building wealth for the future.

Understanding Retirement Planning with Dave Ramsey

Before we dive deeper into the calculator, let's take a moment to understand Dave Ramsey's approach to retirement planning. For Dave, it's not just about saving money—it's about building wealth and living a debt-free life. Here are some key principles:

1. Baby Steps: Dave Ramsey's famous Baby Steps are a roadmap to financial peace. Step 3 focuses on retirement savings, encouraging you to put 15% of your income into retirement accounts.

2. Debt-Free Living: One of the cornerstones of Dave's philosophy is living debt-free. By eliminating debt, you free up more money to invest in your future.

3. Long-Term Focus: Retirement planning isn't a short-term fix; it's a lifelong commitment. Dave emphasizes the importance of staying consistent and patient with your investments.

These principles form the foundation of the retirement investing calculator and ensure that you're building a solid financial future.

Why Dave Ramsey's Approach Works

So, why should you trust Dave Ramsey's methods? Well, for starters, they've been proven to work. Thousands of people have successfully used his strategies to achieve financial independence. Here's why his approach is so effective:

- Proven Track Record: Dave Ramsey's advice has helped millions of people get out of debt and build wealth.

- Community Support: Being part of the Dave Ramsey community means you're never alone on your journey. There are countless resources and support systems available.

- Education First: Dave places a strong emphasis on financial education, ensuring that you understand the "why" behind every decision you make.

It's not just about the calculator—it's about adopting a mindset that prioritizes financial health and long-term success.

Common Retirement Planning Mistakes to Avoid

As you start using the Dave Ramsey retirement investing calculator, it's important to be aware of common mistakes that could derail your plans. Here are a few to watch out for:

1. Starting Too Late: The earlier you start saving, the more time your money has to grow. Don't wait until you're in your 50s to begin thinking about retirement.

2. Underestimating Expenses: Many people underestimate how much money they'll need in retirement. The calculator helps you account for all potential expenses, including healthcare and inflation.

3. Ignoring Inflation: Inflation can significantly impact your purchasing power over time. Make sure your retirement plan accounts for rising costs.

By avoiding these pitfalls, you'll be well on your way to a secure and comfortable retirement.

How the Calculator Helps You Avoid Mistakes

The Dave Ramsey retirement investing calculator is designed to help you avoid these common mistakes. Here's how:

- Realistic Projections: The calculator provides accurate estimates based on current economic data, ensuring that your plan is grounded in reality.

- Adjustable Scenarios: You can tweak different variables to see how they affect your overall plan, allowing you to make informed decisions.

- Comprehensive Guidance: The calculator doesn't just give you numbers—it provides actionable advice on how to improve your financial situation.

With the calculator by your side, you'll have the confidence to make smart financial decisions.

Maximizing Your Retirement Savings

Now that you know how the calculator works and why it's important, let's talk about how to maximize your retirement savings. Here are a few tips:

1. Automate Your Contributions: Set up automatic transfers to your retirement accounts so you never miss a payment.

2. Take Advantage of Employer Matches: If your employer offers a 401(k) match, make sure you're contributing enough to get the full benefit.

3. Diversify Your Investments: Don't put all your eggs in one basket. Spread your investments across different asset classes to minimize risk.

By following these strategies, you'll be able to grow your retirement savings more effectively and ensure a brighter financial future.

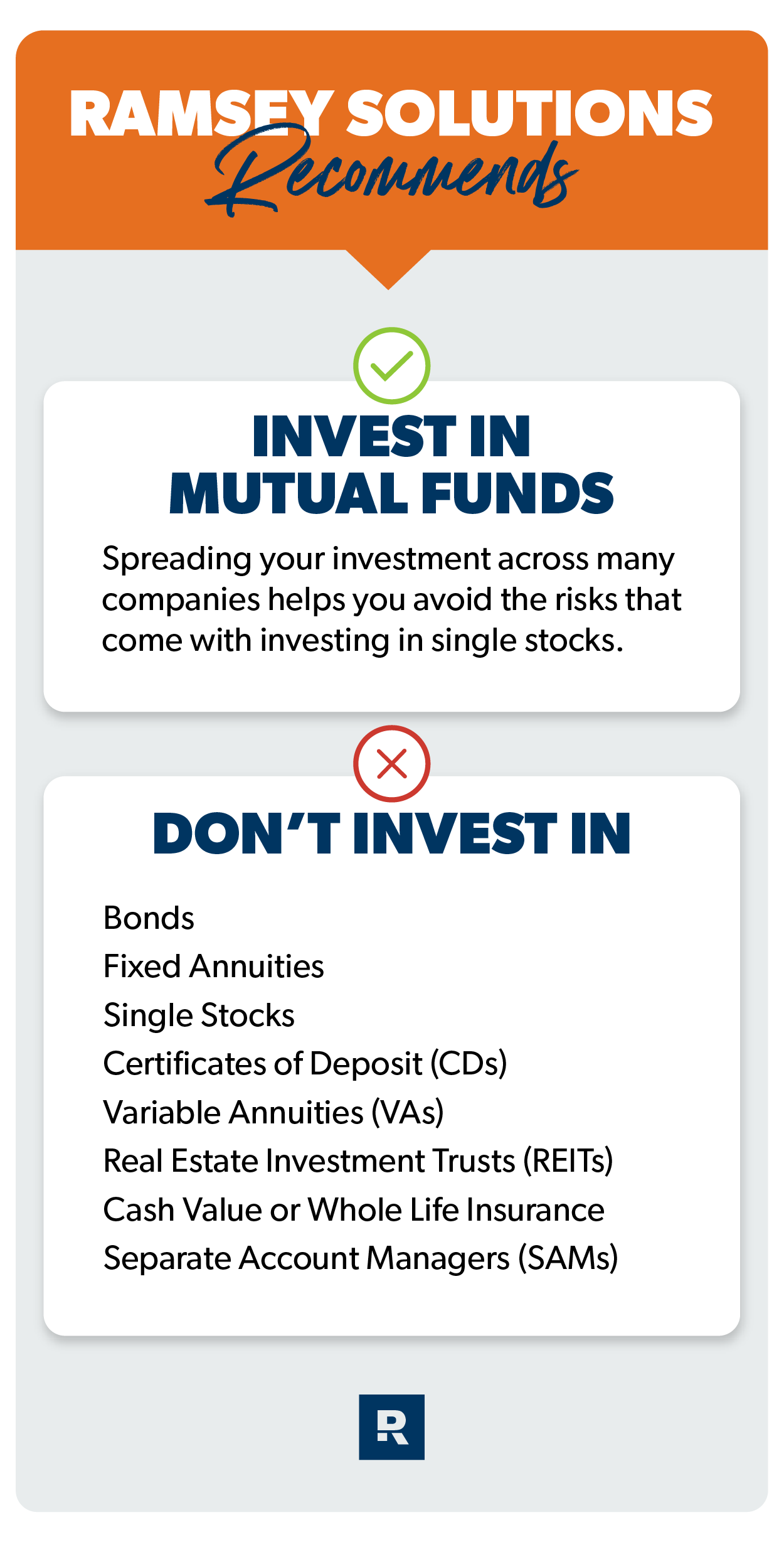

Investment Options to Consider

When it comes to retirement investing, you have a variety of options to choose from. Here are some of the most popular:

- 401(k) Plans: Offered by many employers, 401(k) plans allow you to contribute pre-tax dollars to your retirement savings.

- IRAs: Individual Retirement Accounts come in two main types—Traditional and Roth—each with its own tax advantages.

- Stocks and Bonds: Investing in individual stocks and bonds can provide higher returns but comes with increased risk.

With the Dave Ramsey retirement investing calculator, you can explore these options and find the ones that best fit your financial goals.

Real-Life Success Stories

Let's hear from some real people who have used the Dave Ramsey retirement investing calculator to achieve financial success. Here are a few inspiring stories:

John and Jane: This couple started using the calculator in their early 30s and have since built a retirement fund of over $1 million. They credit the calculator with helping them stay on track and make smart investment decisions.

Mike: A single dad in his 40s, Mike used the calculator to create a retirement plan that allowed him to pay off his debt and start saving for the future. He's now on track to retire comfortably in his 60s.

Susan: Susan began using the calculator in her 50s after realizing she hadn't saved enough for retirement. With the help of the calculator, she was able to adjust her contributions and still achieve her financial goals.

These stories show that it's never too late—or too early—to start planning for retirement.

Lessons Learned from Success Stories

What can we learn from these success stories? Here are a few key takeaways:

- Start Early: The earlier you start saving, the more time your money has to grow.

- Stay Consistent: Consistency is key when it comes to building wealth over time.

- Be Flexible: Life happens, and your retirement plan should be adaptable to changes in your circumstances.

These lessons highlight the importance of using tools like the Dave Ramsey retirement investing calculator to stay on track.

Conclusion: Take Control of Your Financial Future

So, there you have it—a comprehensive guide to the Dave Ramsey retirement investing calculator. Whether you're just starting out or looking to fine-tune your existing plan, this tool can help you achieve your financial goals. Remember, retirement planning isn't a one-time event—it's a lifelong journey. By using the calculator and following Dave Ramsey's principles, you'll be well on your way to a secure and comfortable retirement.

Now, here's the big question: what are you waiting for? Take action today and start using the calculator to build the financial future you deserve. Don't forget to share this article with your friends and family so they can benefit from the wisdom of Dave Ramsey too!

Table of Contents

Here's a quick navigation guide to help you find what you're looking for:

- Why You Need the Dave Ramsey Retirement Investing Calculator

- How the Calculator Works

- Key Features of the Calculator

- Understanding Retirement Planning with Dave Ramsey

- Common Retirement Planning Mistakes to Avoid

- How the Calculator Helps You Avoid Mistakes

- Maximizing Your Retirement Savings

- Investment Options to Consider

- Real-Life Success Stories

- Lessons Learned from Success Stories

401k calculator dave ramsey

Maximize Your Money with Dave Ramsey's Investment Calculator Expert

Dave Ramsey Budget Planner Budgeting Spreadsheet Calculator Etsy