LA County Property Taxes: A Comprehensive Guide For Homeowners

LA County property taxes can be a tricky subject, but don’t panic—this guide will break it all down for you. Whether you’re a first-time homeowner or a seasoned property owner, understanding how property taxes work in LA County is crucial. From the basics to the nitty-gritty details, we’ve got you covered. So grab a coffee, sit back, and let’s dive in.

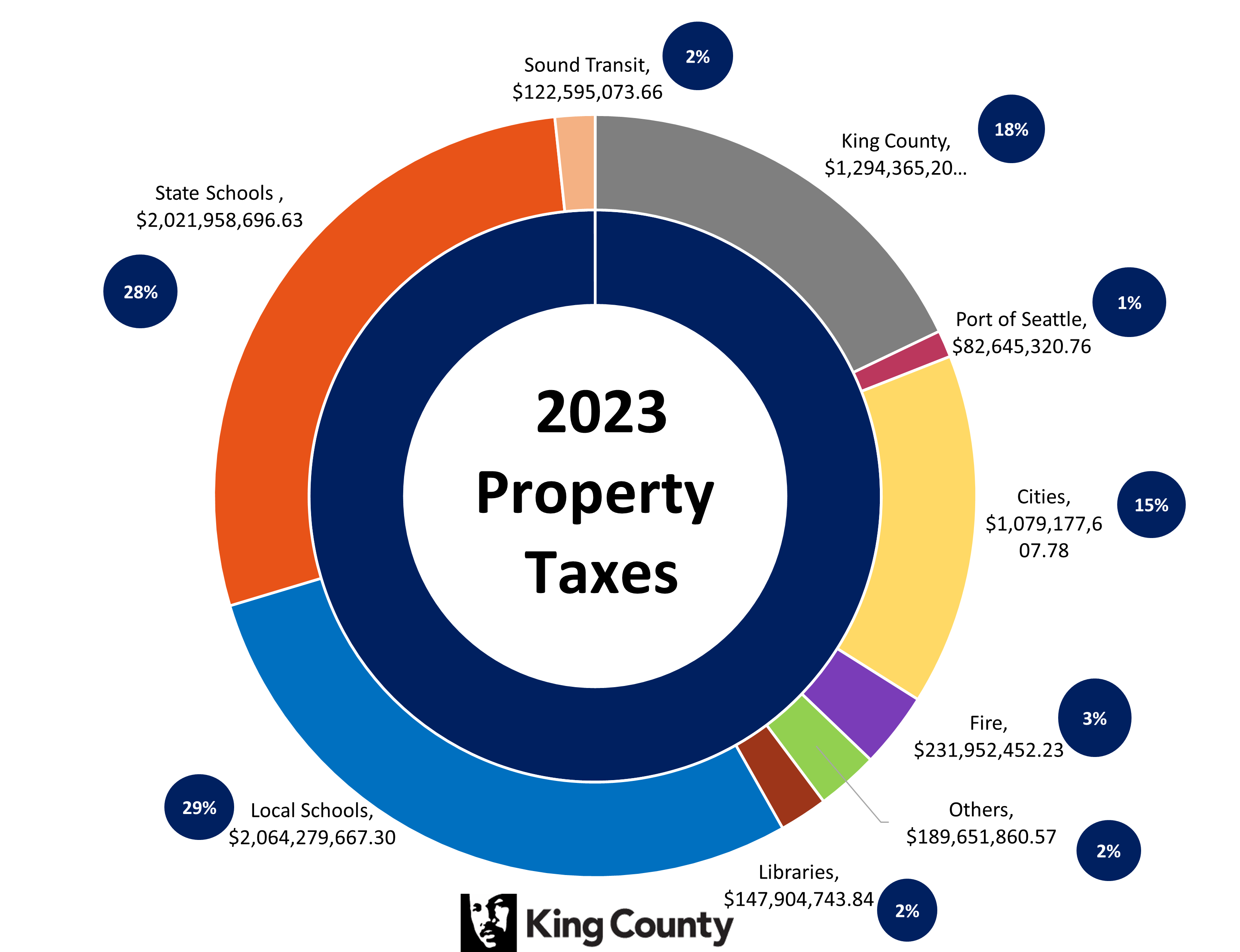

Buying a home is one of the biggest financial decisions you’ll ever make, right? But it doesn’t stop at the purchase price. Property taxes are a significant factor that can impact your budget. In LA County, these taxes are not only a source of revenue for the local government but also play a key role in funding essential services like schools, public safety, and infrastructure.

Now, before we jump into the deep end, let’s clarify something important. LA County property taxes are calculated based on your property’s assessed value, and they can fluctuate depending on various factors. But don’t worry—we’ll explain all of that later. For now, just know that staying informed is your best defense against unexpected tax bills.

Understanding LA County Property Taxes

What Are Property Taxes?

Property taxes, also known as real estate taxes, are a type of tax levied on real estate properties. In LA County, these taxes are used to fund public services, including education, law enforcement, fire protection, and road maintenance. Think of it as your contribution to keeping the community running smoothly.

But here’s the deal: property taxes in LA County are not a flat rate. They’re based on your property’s assessed value, which is determined by the county assessor. This means that if your property increases in value, your tax bill might go up too. And vice versa—if the value drops, so might your taxes.

How Are LA County Property Taxes Calculated?

The calculation of LA County property taxes involves a few key steps. First, the county assessor determines the assessed value of your property. This value is typically a percentage of the market value. Then, the tax rate is applied to that assessed value to calculate your tax bill.

Let’s break it down with an example. Say your property’s assessed value is $500,000, and the tax rate is 1%. Your property tax bill would be $5,000. Easy, right? Well, not exactly. There are a few more factors to consider, like any additional assessments or exemptions that might apply.

Key Factors Affecting LA County Property Taxes

Proposition 13: The Game-Changer

One of the most significant factors affecting LA County property taxes is Proposition 13. Enacted in 1978, this law limits the amount that property taxes can increase each year to no more than 2%. This means that even if your property’s market value skyrockets, your tax bill won’t skyrocket with it—at least not right away.

Proposition 13 also established a base year value for properties, which is the assessed value at the time of purchase. From that point on, the assessed value can only increase by up to 2% annually, unless there’s a change in ownership or new construction.

Assessed Value vs. Market Value

It’s important to understand the difference between assessed value and market value. While the market value reflects what your property might sell for in the current real estate market, the assessed value is what’s used to calculate your property taxes.

In many cases, the assessed value is lower than the market value, which can result in lower tax bills. However, if your property undergoes significant improvements or changes hands, the assessed value might be adjusted to reflect the new market value.

Exemptions and Deductions

Homeowner’s Exemption

If you’re a homeowner in LA County, you might qualify for the Homeowner’s Exemption. This exemption reduces the taxable value of your primary residence by $7,000, effectively lowering your property tax bill. To qualify, you must own and occupy the property as your principal residence.

Applying for the Homeowner’s Exemption is relatively straightforward. You’ll need to file an application with the county assessor’s office, and once approved, the exemption will apply to future tax bills. It’s a great way to save some money on your taxes, so don’t forget to take advantage of it if you’re eligible.

Senior Citizen Exemption

Senior citizens in LA County may also qualify for additional exemptions or deferrals. The Senior Citizen Property Tax Postponement Program allows eligible seniors to defer their property taxes until the property is sold or transferred. This can be a lifesaver for those on fixed incomes who might struggle to pay their tax bills.

To qualify for this program, you must be at least 55 years old, have a combined income of less than $35,500, and meet certain ownership and residency requirements. It’s definitely worth exploring if you or a loved one falls into this category.

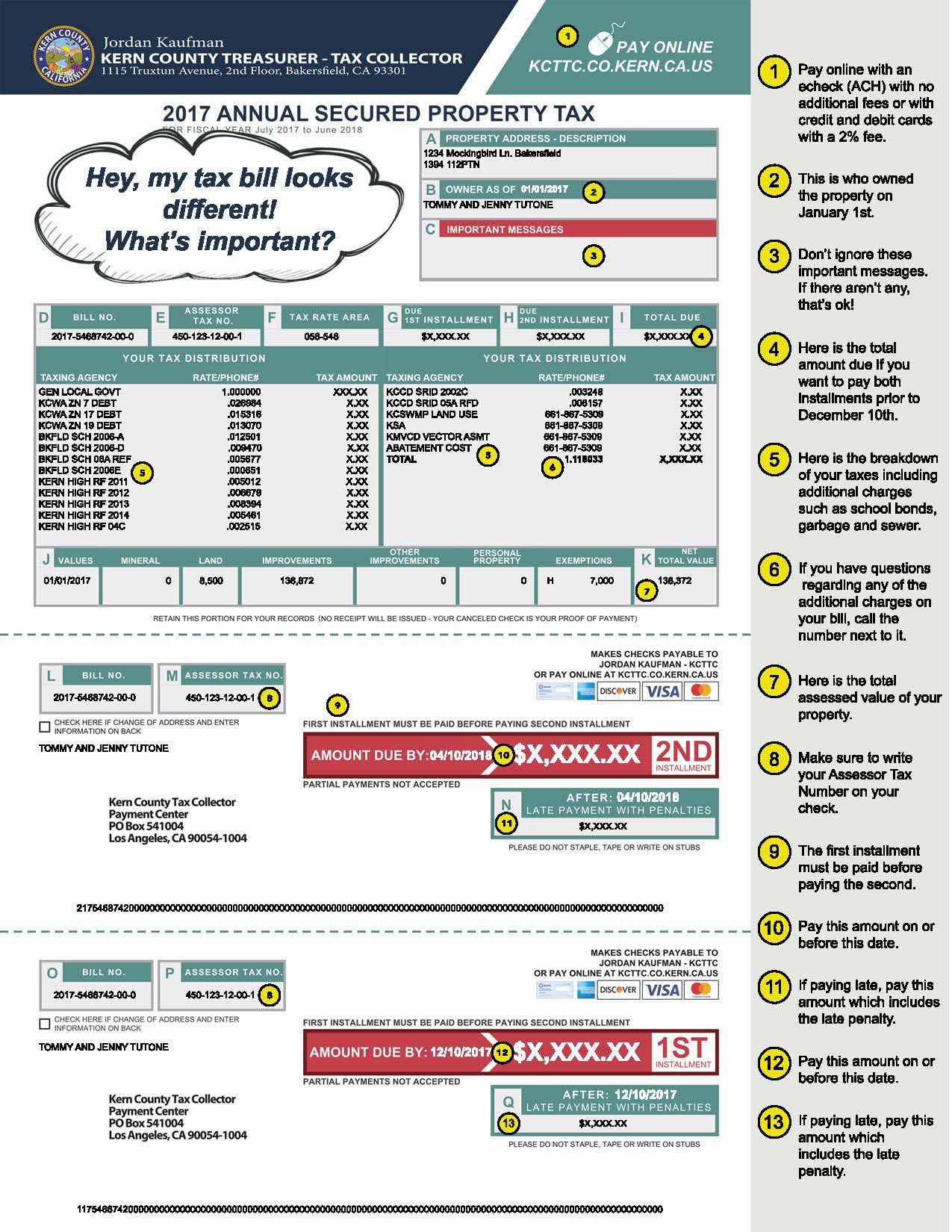

Tax Bills and Payment Options

When Are Property Taxes Due?

In LA County, property tax bills are issued annually and are due in two installments. The first installment is due on November 1 and is considered delinquent if not paid by December 10. The second installment is due on February 1 and is considered delinquent if not paid by April 10.

It’s crucial to pay your taxes on time to avoid penalties and interest charges. If you miss the deadline, you could face a 10% penalty on the amount owed, plus additional fees. So mark those dates on your calendar and set reminders if you need to.

Payment Methods

Paying your LA County property taxes has never been easier. You can pay online through the county treasurer’s website, by mail, or in person at one of the payment centers. Most people opt for the convenience of online payment, but it’s always good to know your options.

When paying online, you’ll need your parcel number, which can be found on your tax bill. Make sure to double-check the amount you’re paying to avoid any mistakes. And if you’re paying by mail, be sure to send your payment well in advance of the due date to ensure it arrives on time.

Appealing Your Property Tax Assessment

When Should You Appeal?

If you believe your property’s assessed value is too high, you have the right to appeal. This might happen if the assessor’s estimate doesn’t reflect the current market conditions or if there are errors in the assessment.

Before filing an appeal, it’s a good idea to gather evidence to support your case. This could include recent property sales in your area, comparable property assessments, or any other relevant information. The more evidence you have, the stronger your appeal will be.

How to File an Appeal

Filing an appeal is a straightforward process, but it does require some preparation. Start by submitting a formal request to the county assessor’s office, outlining your reasons for the appeal and providing any supporting documentation.

Once your appeal is reviewed, you may be invited to attend a hearing to present your case. This is your chance to explain why you believe the assessed value is incorrect and to provide evidence to back up your claims. If your appeal is successful, your assessed value (and therefore your tax bill) may be adjusted accordingly.

Additional Assessments and Fees

Special Assessments

In addition to the standard property tax rate, LA County may impose special assessments for specific services or improvements. These assessments are typically used to fund projects like street repairs, sewer upgrades, or park maintenance.

Special assessments are usually added to your property tax bill and are paid along with your regular taxes. If you’re concerned about these additional fees, you can contact the county assessor’s office to learn more about any assessments that apply to your property.

Other Fees and Charges

There are also other fees and charges that might appear on your property tax bill. These can include administrative fees, penalties for late payments, or interest charges on overdue balances. It’s important to review your bill carefully to ensure everything is accurate and to address any discrepancies promptly.

Future Trends in LA County Property Taxes

Proposition 19: The New Rules

In 2021, California voters passed Proposition 19, which introduced some significant changes to property tax laws. One of the key provisions of this measure allows homeowners over the age of 55 to transfer their primary residence’s tax base to a new home, regardless of price or location, up to three times.

This change could have a big impact on how property taxes are calculated in LA County, especially for older homeowners looking to downsize or move to a different area. It’s definitely something to keep an eye on as the law continues to be implemented.

Market Trends and Their Impact

As with any real estate market, trends can have a big impact on property values and, by extension, property taxes. In recent years, LA County has seen a surge in home prices, which could lead to higher assessed values and, consequently, higher tax bills.

However, Proposition 13’s 2% cap on annual increases helps to mitigate some of these effects. Still, it’s important to stay informed about market trends and how they might affect your property taxes in the future.

Resources for LA County Homeowners

County Assessor’s Office

The LA County Assessor’s Office is your go-to resource for all things related to property taxes. Their website provides a wealth of information, including tax rates, assessed values, and appeal procedures. You can also find contact information for their staff, who are available to answer any questions you might have.

Another great resource is the LA County Treasurer and Tax Collector’s website. Here, you can view your tax bill, make payments, and access other useful tools and information. Both of these resources are invaluable for staying on top of your property tax obligations.

Local Real Estate Experts

If you’re looking for more personalized advice, consider consulting with a local real estate expert. They can provide insights into market trends, help you understand your property’s assessed value, and guide you through the appeals process if needed.

Many real estate agents and brokers offer free consultations, so don’t hesitate to reach out if you have questions or concerns. Their expertise can be a valuable asset in navigating the sometimes confusing world of property taxes.

Conclusion

Understanding LA County property taxes is essential for any homeowner. From the basics of how they’re calculated to the various exemptions and deductions available, there’s a lot to consider. But with the right information and resources, you can stay on top of your tax obligations and make informed decisions about your property.

Remember to keep track of important dates, review your tax bill carefully, and take advantage of any available exemptions or appeals. And if you ever have questions or need assistance, don’t hesitate to reach out to the county assessor’s office or a local real estate expert.

So there you have it—a comprehensive guide to LA County property taxes. We hope this article has been helpful and informative. If you found it useful, feel free to share it with your friends and family. And don’t forget to leave a comment below—we’d love to hear your thoughts!

Table of Contents

- Understanding LA County Property Taxes

- Key Factors Affecting LA County Property Taxes

- Exemptions and Deductions

- Tax Bills and Payment Options

- Appealing Your Property Tax Assessment

- Additional Assessments and Fees

- Future Trends in LA County Property Taxes

- Resources for LA County Homeowners

- Conclusion

THE TREASURER AND TAX COLLECTOR CONTINUES TO MAIL THE 2024 ANNUAL

la county tax collector mailing address Vinita Witt

King County Property Tax King County