Trade Machine: Unlocking The Future Of Trading With Cutting-Edge Technology

Ever wondered how machines are reshaping the trading world? Trade machine technology is revolutionizing the financial landscape, and it’s here to stay. Imagine having a tool that analyzes data, predicts trends, and executes trades faster than any human ever could. This isn’t science fiction—it’s happening right now! Whether you’re a seasoned trader or just starting out, understanding trade machines can give you an edge in the competitive world of finance.

Trading has always been about timing, knowledge, and strategy. But what happens when machines step into the game? They bring precision, speed, and efficiency that no human trader can match. Trade machines are designed to process vast amounts of data in seconds, making them indispensable tools for anyone looking to stay ahead in the market.

In this article, we’ll dive deep into the world of trade machines, exploring their capabilities, benefits, challenges, and future potential. By the end, you’ll have a clear understanding of how these machines work and why they’re becoming essential in modern trading. So, buckle up—it’s going to be a wild ride!

Let’s break it down with this handy table of contents:

- What is a Trade Machine?

- The History of Trade Machines

- How Trade Machines Work

- Benefits of Using Trade Machines

- Challenges and Risks

- Types of Trade Machines

- Real-World Applications

- The Future of Trade Machines

- Regulations Surrounding Trade Machines

- Conclusion

What is a Trade Machine?

A trade machine refers to any automated system or software designed to execute trades in financial markets without human intervention. These machines rely on algorithms, artificial intelligence, and machine learning to analyze market data, identify patterns, and make informed decisions. In simple terms, think of a trade machine as a super-smart robot that handles all the heavy lifting while you sit back and relax.

Trade machines come in various forms, from basic algorithmic trading systems to advanced AI-driven platforms. They’re used by everyone from individual traders to large financial institutions, and they’re transforming the way people approach trading. But how did we get here? Let’s take a trip down memory lane.

The History of Trade Machines

Believe it or not, trade machines have been around for longer than you might think. The concept of automated trading dates back to the early 1980s when computers first started being used in financial markets. Back then, these systems were relatively simple, relying on basic rules-based algorithms to execute trades.

Early Days of Automation

In the late 1980s and early 1990s, as technology advanced, so did the capabilities of trade machines. Traders began using more sophisticated algorithms to identify trends and execute trades at lightning speed. This period marked the beginning of high-frequency trading (HFT), which would later become a dominant force in the market.

The Rise of AI

Fast forward to the 2010s, and we saw the emergence of AI-powered trade machines. These systems could learn from past data, adapt to changing market conditions, and even predict future trends. Today, trade machines are more advanced than ever, capable of handling complex tasks that were once thought impossible.

How Trade Machines Work

So, how exactly do trade machines operate? At their core, these systems rely on three key components: data analysis, decision-making, and execution. Here’s a quick breakdown:

- Data Analysis: Trade machines process vast amounts of data from various sources, including stock prices, news articles, and social media trends. This data is then analyzed to identify patterns and opportunities.

- Decision-Making: Using algorithms and AI, trade machines evaluate the data and decide whether to buy, sell, or hold a particular asset.

- Execution: Once a decision is made, the machine executes the trade automatically, often in milliseconds.

It’s like having a personal trading guru who never sleeps, never gets tired, and never makes emotional decisions. Sounds pretty sweet, right?

Benefits of Using Trade Machines

Now that we know how trade machines work, let’s talk about why they’re so popular. Here are some of the top benefits:

- Speed: Trade machines can execute trades in fractions of a second, giving them a significant advantage over human traders.

- Precision: By eliminating human error, trade machines ensure that every trade is executed exactly as intended.

- Efficiency: These machines can handle multiple trades simultaneously, allowing traders to maximize their profits.

- Consistency: Unlike humans, trade machines don’t get emotional or make irrational decisions. They stick to their strategies no matter what.

But, of course, nothing’s perfect. Let’s explore some of the challenges and risks associated with trade machines.

Challenges and Risks

While trade machines offer many advantages, they’re not without their drawbacks. Here are some of the main challenges and risks:

- Market Volatility: Trade machines can struggle during periods of extreme market volatility, leading to unexpected losses.

- System Failures: Like any technology, trade machines are susceptible to glitches and crashes, which can have devastating consequences.

- Regulatory Issues: As trade machines become more prevalent, governments and regulatory bodies are stepping in to ensure they’re used responsibly.

Despite these challenges, the benefits of trade machines often outweigh the risks, especially for those who use them wisely.

Types of Trade Machines

Not all trade machines are created equal. Here’s a look at some of the most common types:

Algorithmic Trading Systems

These systems use predefined rules to execute trades based on specific market conditions. They’re great for beginners but lack the sophistication of more advanced systems.

High-Frequency Trading (HFT) Platforms

HFT platforms are designed to execute trades at lightning speed, often using complex algorithms to identify fleeting opportunities in the market.

AI-Powered Trading Systems

These cutting-edge systems use artificial intelligence to learn from past data, adapt to changing conditions, and make predictions about future trends. They’re the cream of the crop when it comes to trade machines.

Real-World Applications

Trade machines aren’t just theoretical—they’re being used in real-world scenarios every day. Here are a few examples:

- Hedge Funds: Many hedge funds rely on trade machines to execute complex strategies and maximize returns.

- Individual Traders: Everyday traders are increasingly adopting trade machines to level the playing field against larger institutions.

- Financial Institutions: Banks and other financial institutions use trade machines to manage risk and optimize their portfolios.

As these machines become more accessible, their applications will only continue to grow.

The Future of Trade Machines

So, where is this all headed? The future of trade machines looks bright, with advancements in AI, quantum computing, and blockchain technology set to take things to the next level. Imagine trade machines that can predict market movements with near-perfect accuracy or execute trades across multiple blockchain networks simultaneously. It’s not a matter of if—it’s a matter of when.

Of course, as trade machines become more advanced, ethical considerations will come into play. How do we ensure that these machines are used responsibly? How do we prevent them from causing harm? These are questions that will need to be addressed as the technology continues to evolve.

Regulations Surrounding Trade Machines

As trade machines become more prevalent, governments and regulatory bodies are stepping in to ensure they’re used responsibly. Here are some of the key regulations:

- SEC Guidelines: In the United States, the Securities and Exchange Commission (SEC) has issued guidelines for the use of trade machines in financial markets.

- EU MiFID II: The European Union’s Markets in Financial Instruments Directive (MiFID II) includes provisions for the regulation of algorithmic trading.

- Global Standards: Organizations like the International Organization of Securities Commissions (IOSCO) are working to establish global standards for the use of trade machines.

These regulations aim to protect investors while promoting innovation in the financial industry.

Conclusion

Trade machines are changing the game in the world of finance, offering unprecedented speed, precision, and efficiency. While they come with their own set of challenges and risks, the benefits they provide make them an invaluable tool for traders of all levels.

As we look to the future, the potential of trade machines is limitless. With advancements in AI, quantum computing, and blockchain technology, the possibilities are endless. But with great power comes great responsibility, and it’s up to us to ensure that these machines are used responsibly and ethically.

So, what are you waiting for? Dive into the world of trade machines and see how they can help you achieve your financial goals. And don’t forget to share your thoughts in the comments below—we’d love to hear from you!

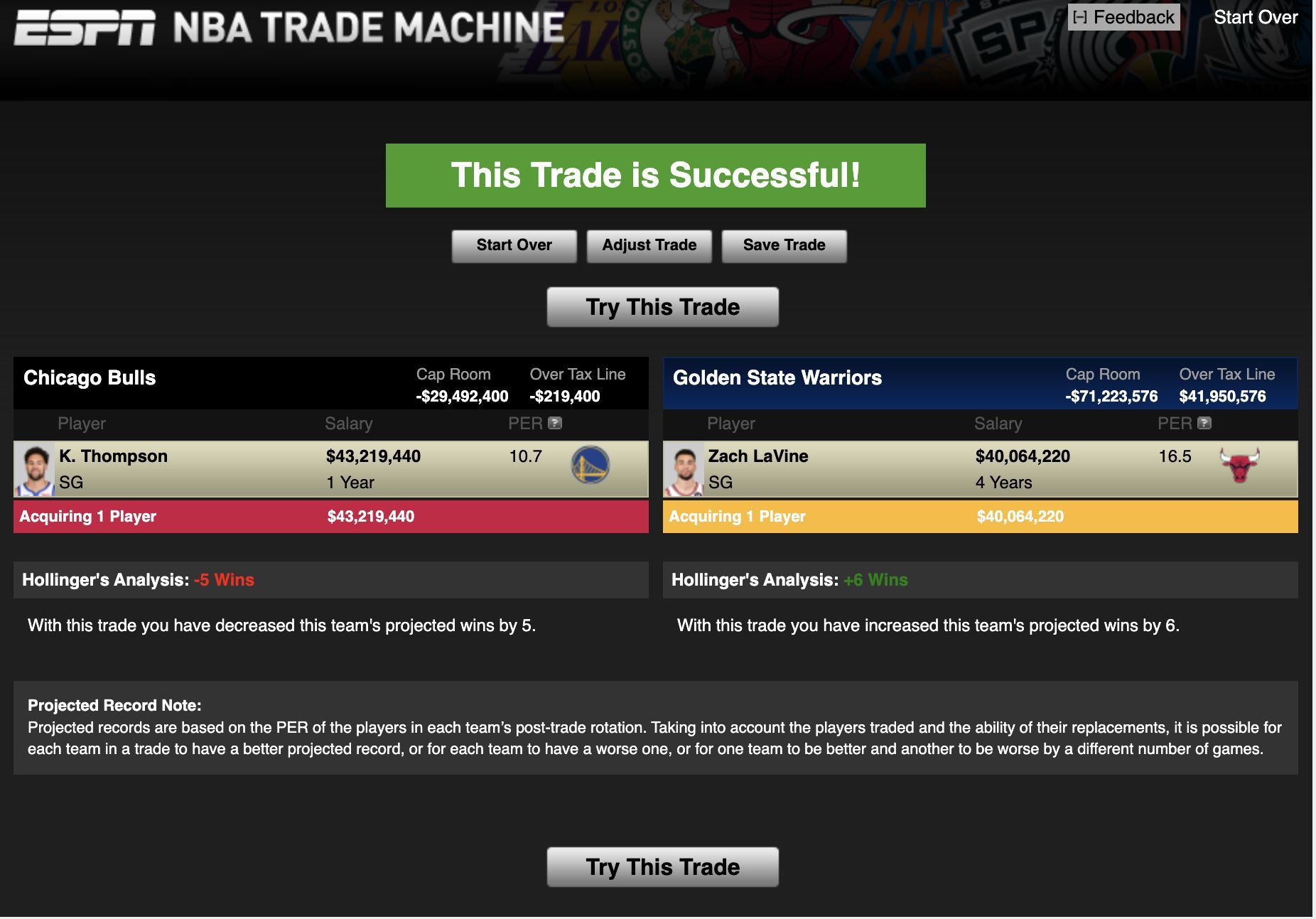

NBA Trade Machine Which players can Chicago Bulls acquire by trading

NBA Trade Machine Which players can Chicago Bulls acquire by trading

Trade Machine image Pokémon World 3D IndieDB