Sales Tax Rate Santa Clara County CA: A Comprehensive Guide To Understanding Your Taxes

So, let's cut straight to the chase. If you're diving into the world of sales tax in Santa Clara County, CA, you're not alone. Whether you're a small business owner or someone who's just curious about how much you're paying at the checkout counter, understanding the sales tax rate Santa Clara County CA is crucial. This tax isn’t just a number—it affects your wallet, your business, and even your financial planning. Stick around, because we’re about to break it down for you in a way that’s easy to digest.

First off, let’s not sugarcoat it. Taxes can get complicated, especially when you’re dealing with local, state, and federal levels. But don’t worry, we’re here to simplify it for you. The sales tax rate in Santa Clara County, California, is something you need to know if you’re living, working, or running a business in the area. From the latest updates to the breakdown of how it all works, we’ll cover everything you need to stay informed.

Now, here’s the deal: Whether you’re shopping for groceries, electronics, or even services, understanding how sales tax works is key to managing your finances. And if you’re a business owner, knowing the ins and outs of the Santa Clara County sales tax rate can save you from potential headaches down the road. So, buckle up, because we’re about to deep-dive into everything you need to know.

What You Need to Know About the Sales Tax Rate Santa Clara County CA

Alright, let’s start with the basics. The sales tax rate in Santa Clara County, CA, is a combination of different tax layers. It’s not just one flat rate; it’s a mix of state, county, and sometimes even city-specific taxes. As of the latest update, the total sales tax rate in Santa Clara County is 9.25%. But wait, there’s more. Some cities within the county have their own additional taxes, which means the rate can vary depending on where you are in the county.

Here’s the breakdown: The base state sales tax in California is 7.25%. On top of that, Santa Clara County adds an additional 2% to the rate. And then, depending on the city you’re in, there might be an extra 0.1% or more. So, if you’re shopping in San Jose, the rate might be slightly different from if you’re shopping in Cupertino or Mountain View. It’s a bit like a puzzle, but once you understand the pieces, it all starts to make sense.

How the Sales Tax Rate Affects You

Now, let’s talk about why this matters to you. Whether you’re a consumer or a business owner, the Santa Clara County sales tax rate has a direct impact on your finances. For consumers, it affects how much you pay at the register. For businesses, it impacts how much you collect from customers and how much you owe to the government.

For instance, if you’re buying a $100 item, you’re not just paying $100. You’re also paying an additional 9.25% in sales tax, which means the total cost is $109.25. Now, imagine scaling that up for larger purchases or even everyday items. It adds up pretty quickly, right? And if you’re a business owner, you need to ensure you’re collecting the right amount of tax and remitting it to the appropriate authorities. Failure to do so can result in penalties and fines.

Key Factors Influencing the Sales Tax Rate

So, what exactly influences the Santa Clara County sales tax rate? There are a few key factors to consider:

- State Tax: The base rate set by the state of California.

- County Tax: The additional rate added by Santa Clara County.

- City Tax: Some cities within the county have their own tax rates, which can vary.

- Special District Taxes: These are additional taxes imposed for specific purposes, like funding public transportation or infrastructure projects.

Understanding these layers is essential if you want to get a clear picture of how much you’re actually paying in sales tax. It’s not just one number; it’s a combination of several factors that come together to form the final rate.

Breaking Down the Sales Tax Rate by City

Let’s dive deeper into the specifics. As mentioned earlier, the sales tax rate can vary depending on the city you’re in. Here’s a quick look at some of the major cities in Santa Clara County and their respective sales tax rates:

San Jose

San Jose, being the largest city in the county, has a sales tax rate of 9.25%. This includes the base state rate, the county rate, and any additional city-specific taxes. Keep in mind that this rate can change, so it’s always a good idea to double-check with the local tax authorities or the California Department of Tax and Fee Administration (CDTFA).

Sunnyvale

In Sunnyvale, the sales tax rate is also 9.25%. However, if there are any new developments or changes in local tax policies, this rate could fluctuate. Always stay updated to ensure you’re paying the correct amount.

Cupertino

Cupertino follows the same pattern, with a sales tax rate of 9.25%. But again, keep an eye out for any updates or changes that might affect the rate.

Understanding the Tax Code

Now, let’s talk about the nitty-gritty. The Santa Clara County sales tax rate is governed by a complex set of rules and regulations. These are outlined in the California tax code, which can be a bit overwhelming if you’re not familiar with it. But don’t worry, we’ll break it down for you.

First off, the California Department of Tax and Fee Administration (CDTFA) is the governing body responsible for overseeing sales tax in the state. They set the rates, enforce the rules, and ensure that businesses and consumers are complying with the law. If you’re a business owner, you’ll need to register with the CDTFA and obtain a seller’s permit. This permit allows you to legally collect sales tax from your customers and remit it to the appropriate authorities.

How to Calculate Sales Tax

Calculating sales tax might seem like a chore, but it’s actually pretty straightforward. Here’s a quick formula to help you out:

Sales Tax = Purchase Price × Sales Tax Rate

For example, if you’re buying a $200 item and the sales tax rate is 9.25%, the calculation would look like this:

Sales Tax = $200 × 0.0925 = $18.50

Total Cost = $200 + $18.50 = $218.50

Easy peasy, right? But if you’re dealing with larger transactions or multiple items, it might be worth using a sales tax calculator to save yourself some time and hassle.

Common Misconceptions About Sales Tax

There are a few common misconceptions about sales tax that we need to clear up. First off, not everything is subject to sales tax. In California, items like groceries, prescription medications, and certain medical devices are exempt from sales tax. This means you won’t pay the Santa Clara County sales tax rate on these items. However, prepared food, like meals from restaurants, is still subject to sales tax.

Another misconception is that sales tax is the same everywhere in California. As we’ve already discussed, this isn’t true. The rate can vary depending on the county and city you’re in. So, if you’re planning to shop in a different city or county, it’s a good idea to check the local tax rate beforehand.

How Businesses Can Stay Compliant

If you’re a business owner, staying compliant with sales tax regulations is crucial. Failure to do so can result in hefty fines and penalties. Here are a few tips to help you stay on the right side of the law:

- Register with the CDTFA: Make sure you have a valid seller’s permit.

- Collect the Correct Amount: Ensure you’re collecting the right amount of sales tax from your customers.

- Remit Taxes on Time: Pay your sales tax to the appropriate authorities by the deadline.

- Keep Accurate Records: Maintain detailed records of all transactions and tax payments.

By following these steps, you can avoid any potential legal issues and ensure that your business remains in good standing.

Future Trends in Sales Tax

As we look to the future, there are a few trends in sales tax that are worth noting. With the rise of e-commerce, states are increasingly cracking down on online retailers to ensure they’re collecting and remitting sales tax correctly. This means that even if you’re shopping online, you might still be subject to the Santa Clara County sales tax rate, depending on the retailer’s location and nexus.

Additionally, there’s been a push towards simplifying the sales tax system. Some states are working on creating uniform tax rates and regulations to make it easier for businesses and consumers to comply. While California hasn’t fully embraced this yet, it’s something to keep an eye on as the tax landscape continues to evolve.

Conclusion

And there you have it, folks. The Santa Clara County sales tax rate isn’t just a number; it’s a crucial part of the financial landscape in California. Whether you’re a consumer or a business owner, understanding how it works and how it affects you is essential. From the base state rate to the county and city-specific taxes, it’s a complex system that requires attention to detail.

So, what’s next? If you’re a business owner, make sure you’re registered with the CDTFA and collecting the correct amount of sales tax. If you’re a consumer, keep an eye out for any changes in the tax rate and plan your purchases accordingly. And if you’re still unsure about anything, don’t hesitate to reach out to a tax professional or the local tax authorities for clarification.

Before you go, we’d love to hear from you. Do you have any questions about the Santa Clara County sales tax rate? Or maybe you have some tips for staying compliant? Drop a comment below and let’s keep the conversation going. And if you found this article helpful, don’t forget to share it with your friends and colleagues. Knowledge is power, and when it comes to taxes, the more you know, the better off you’ll be.

Table of Contents

- What You Need to Know About the Sales Tax Rate Santa Clara County CA

- How the Sales Tax Rate Affects You

- Key Factors Influencing the Sales Tax Rate

- Breaking Down the Sales Tax Rate by City

- Understanding the Tax Code

- How to Calculate Sales Tax

- Common Misconceptions About Sales Tax

- How Businesses Can Stay Compliant

- Future Trends in Sales Tax

- Conclusion

El Monte Sales Tax Rate 2024 Morna Tiertza

Florida Sales Tax By County 2025 Lucas E. Mogensen

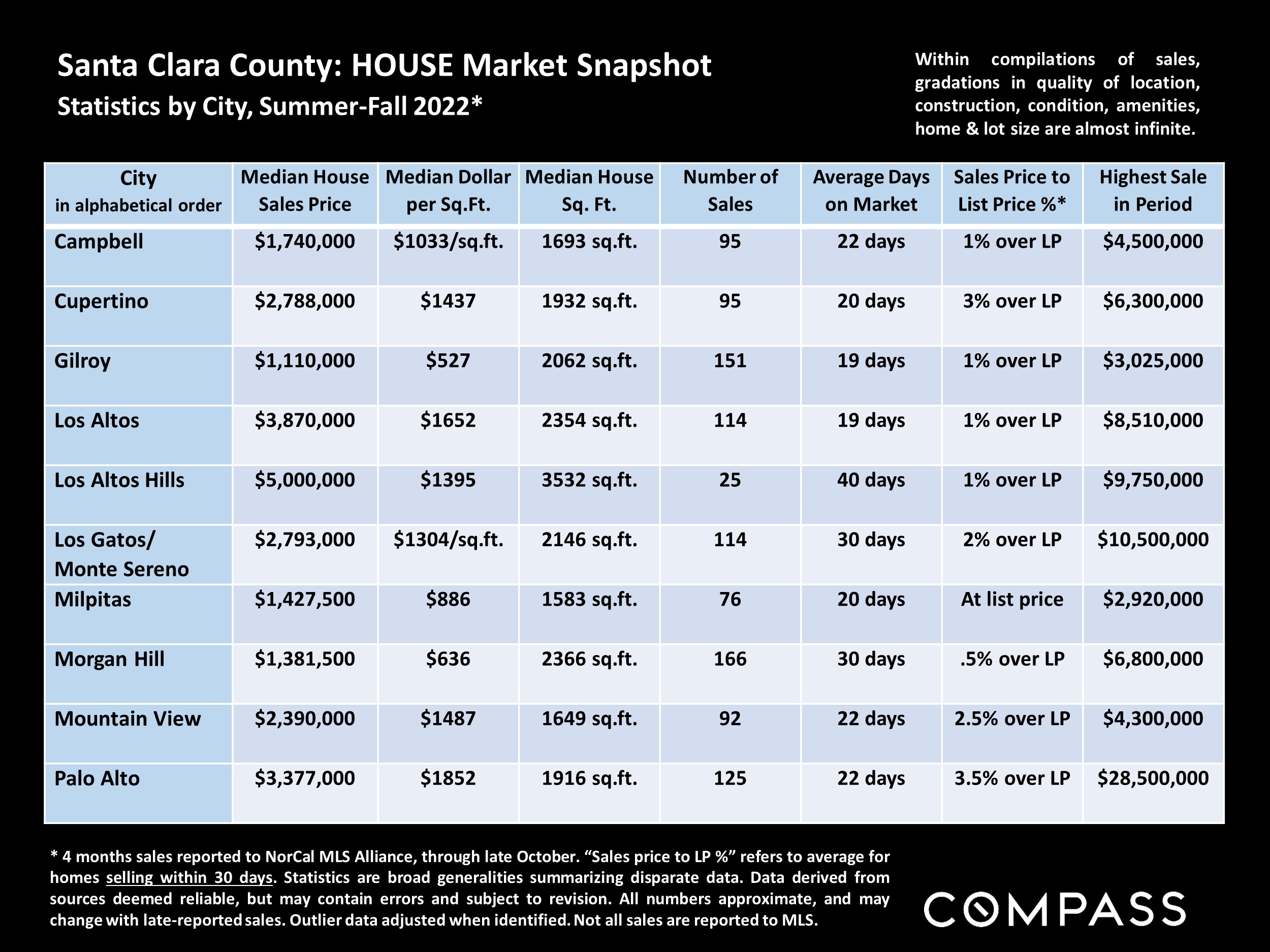

Santa Clara County Real Estate November 2022 Market Report